| Welcome to the April issue of the Select Wealth Management Dashboard Newsletter. WOW - what a roller coaster ride! It seems that not a day goes by without another twist and turn to the tariff saga. Tariffs deferred, tariffs "on again, off again", tariffs exempt, tariffs increased, tariffs decreased... All the while, businesses are trying to calculate the impact this has on them, and how to react. As a result, stock markets are yoyoing between optimism and pessimism. It's unnerving.

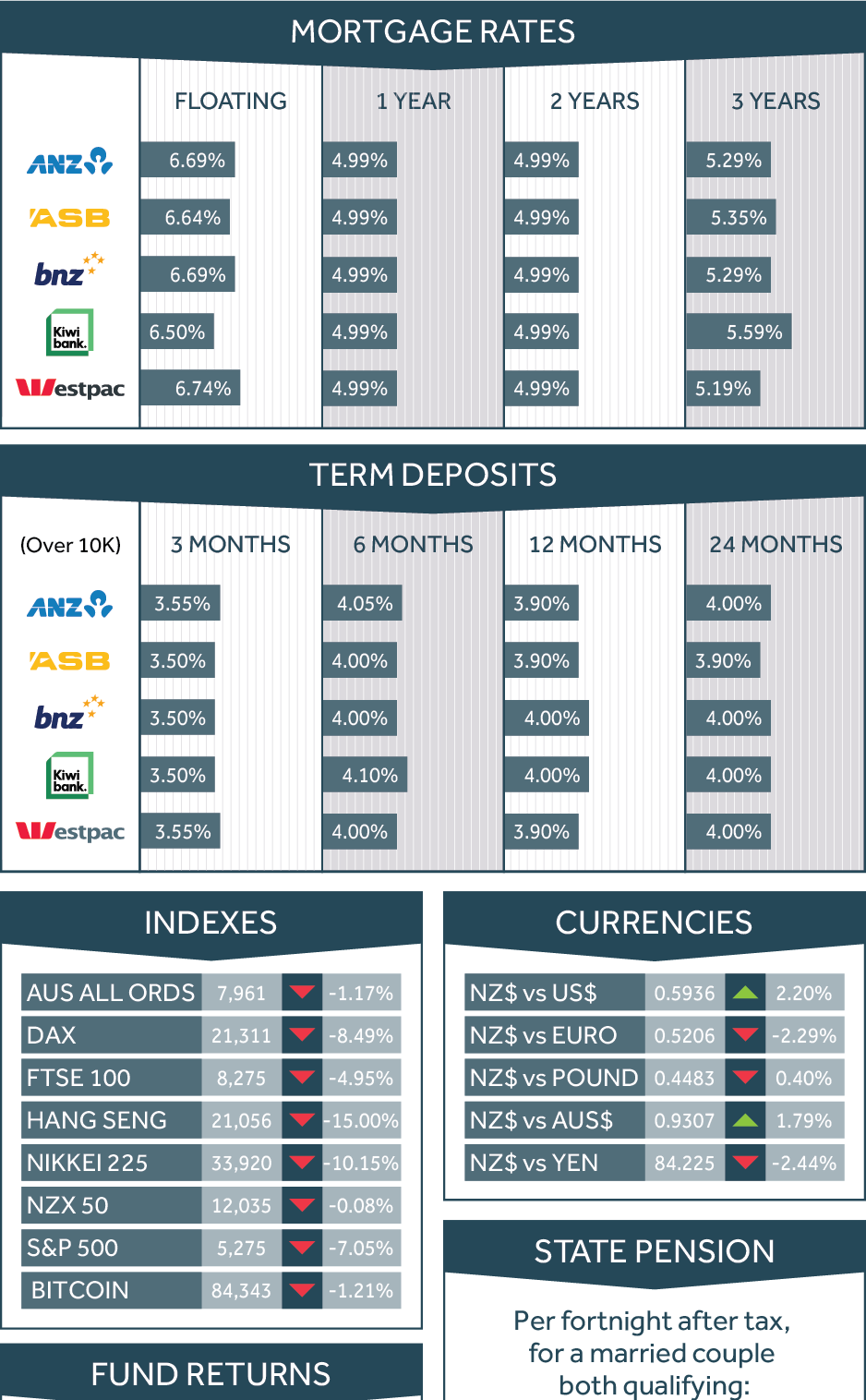

And of course the media absolutely LOVE this. There is no better environment to sell advertising than the current. Don't expect media outlets to dial down the coverage any time soon - the longer they can drag this out, the better (for them of course). So with this in mind, I thought I would use this month's newsletter to try and balance the perspective and share some optimism. I like to think I am a naturally optimistic person. I believe that most people are intrinsically good people, and on balance, things are continuously improving. At the same time, I also make every effort to ensure that this optimism doesn't spill over into naivete. Hope is not a strategy. But if I reflect and compare where we are now as a society to where we were as recently as 10; 20 or 30 years ago, I am always blown away at what progress we have made in such a short period of time. We really are living through a revolution. There are the obvious ones - like the internet for example. My kids were born in the years 2000 and 2003. They can't believe that there was a world without internet. To them, this is simply unfathomable - internet to them is a human right, not a miracle. But the internet only became mainstream in the late 1990's. And my 5G mobile connection today is literally millions of times better than the dial up connection I had back then. This is positive change on a scale that we could never have imagined at the time. The smartphone. Another piece of technology / equipment that almost everyone owns and uses now. I'd be lost without mine! It has my diary, navigates me around with google maps, pays my bills when I tap it against a retailers EFTPOS machine (how the heck does it do that!!!???), stores my photos, replaced my bank branch, my radio, my camera, the library, the list goes on... Yet the first ever iPhone was only released 18 years ago in 2007. Think what a seismic shift this has created in 18 years. There are equally as ground breaking positive developments happening right now that are beyond our wildest imaginations that will most likely become equally as ubiquitous as the internet and iPhone in the future. Doesn't that excite you? It excites me - to the point where I can't be anything other than optimistic. Since I woke up this morning (it's 1.33pm as I write), I have seen or read a dozen things that I marvel at. While I was having my coffee in bed this morning, I stumbled upon this article about Noland Arbaugh. Noland is a quadriplegic, and in January 2024 was the first ever patient to have a chip surgically implanted on his brain to translate his thoughts into computer commands. He can control a computer mouse with his thoughts! This is unbelievable! Think of the possibilities. Once I got to the office a few hours later, I read here that BYD (the Chinese Electric Vehicle manufacturer) has just developed a battery that can charge up to 400kms in 5 minutes. This is an incredible breakthrough - EVs are getting to a point where recharging will take the same time as filling the tank in a petrol car. An hour ago, I was standing in a queue waiting to pay for my sandwich, and the person in front of me had one of those implants on their head to restore hearing. I have no idea how it works, but a quick google search explained that "A cochlear implant is a surgically implanted electronic device that can restore hearing or improve hearing in individuals with severe to profound hearing loss. It bypasses damaged parts of the ear and directly stimulates the auditory nerve, offering a sense of sound, particularly for speech." Isn't this incredible. 30 years ago, that person would never have heard, and their life would be materially impaired. Today, not so. These are incredible, positive things that are happening all around us, and we don't have to look too far to find them. Granted, not all things are good, and some of these developments have negative impacts too. (Facebook and the advent of social media has had a net negative impact if you ask me). But on balance, the world is improving and solving incredibly complex problems. And I believe this trend will continue. Right now feels like a very scary, volatile and negative time - it would be naïve to suggest anything else. My approach is to try educate myself as much as possible on the issues, and take some comfort in the fact that it'll pass in time, and progress will continue. And historically, the greater the problem, the more effective and revolutionary the solution. Climate change - the smartest minds in the world are working together to find cleaner energy, sustainable practices, a solution to the problem. Global politics - the next generation will remember this division and do all they can to achieve better outcomes. Progress marches on. Invest like an optimist, save like a pessimist. This is one of the best pieces of advice I was ever given. I firmly believe that the world will continue to progress, so I need to invest optimistically to participate in this. (I don't want to miss the next Apple or Google...). But at the same time, it would be niave to think that there won't be periods of uncertainty, so I need to be prudent and save enough to see me through these periods. This is the intersection where you will find Financial Planning. In terms of the share markets, the past month has continued to display volatility, and there has been a wider dispersion of results. Last month, Hong Kong's Hang Seng (a proxy for the Chinese market) was the best performing, up nearly 8%. This month, it is the worst performing at -15%. American markets are down 7%, but New Zealand and Australian markets were flat and down 1% respectively (a realisation that tariffs will have muted effects on New Zealand). Currencies were mixed, and mortgage and deposit rates continue to fall (the Reserve Bank of New Zealand reduce the Official Cash Rate by 0.25% to 3.50% last Wednesday). House prices responded by eking out a small gain of 0.10% from last month. The other big development was the pay increase that all superannuants received on the 1st of April. A retired married couple now receive $828.34 after tax per fortnight each - an increase of 3.67%. I can not over emphasize how material this benefit is - $43,074 per annum after tax. Say what you want, but that is an extremely generous pension, and one that we should not take for granted. Here are the numbers: |

||||||

|

||||||

In terms of your Select Wealth Management portfolio, you should by now have received your March quarterly performance reports. It has obviously been a tough quarter with marginally negative returns. However, despite this, we remain very comfortable with our portfolios and fund managers. Portfolios have held up well under extremely testing conditions. If you have any questions regarding your portfolio or would like to meet to review your plan, please do not hesitate to contact me - we are here to help. Finally, a quick update on the Giving Back campaign. We are having a great campaign and have raised $1,100 for Lower Hutt Woman's Refuge so far. I am confident that we will reach our goal of $2,500 by June 2025. As always, thank you for the referral of family and friends which enables us to continue this initiative. To keep track of the Giving Back program visit https://mifinancialplanning.co.nz/giving-back.html to learn more in the meantime. That's all for now. Chat again soon Warm regards Dave and the team at Makowem & Isaacs Financial Planning dave@mifinancialplanning.co.nz |

||||||

|

||||||

This newsletter is intended for general distribution and does not constitute personal financial advice.